Market Capitalization

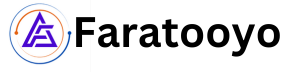

Market capitalization, often referred to as “market cap,” is a crucial metric for evaluating the size and value of a cryptocurrency. It is calculated by multiplying the current price of a single coin or token by the total number of coins or tokens in circulation. This metric provides investors with a snapshot of a cryptocurrency’s market value, allowing them to compare it with others and assess its relative importance in the market.

Why Market Capitalization Matters for Cryptocurrency Investments

When considering the Top Cryptocurrency Investments for 2025, market capitalization is a key factor because it reflects the level of trust and adoption within the market. Generally, cryptocurrencies with a higher market cap are considered more stable and less susceptible to extreme volatility. These are often referred to as “blue-chip” cryptocurrencies, similar to established companies in the stock market.

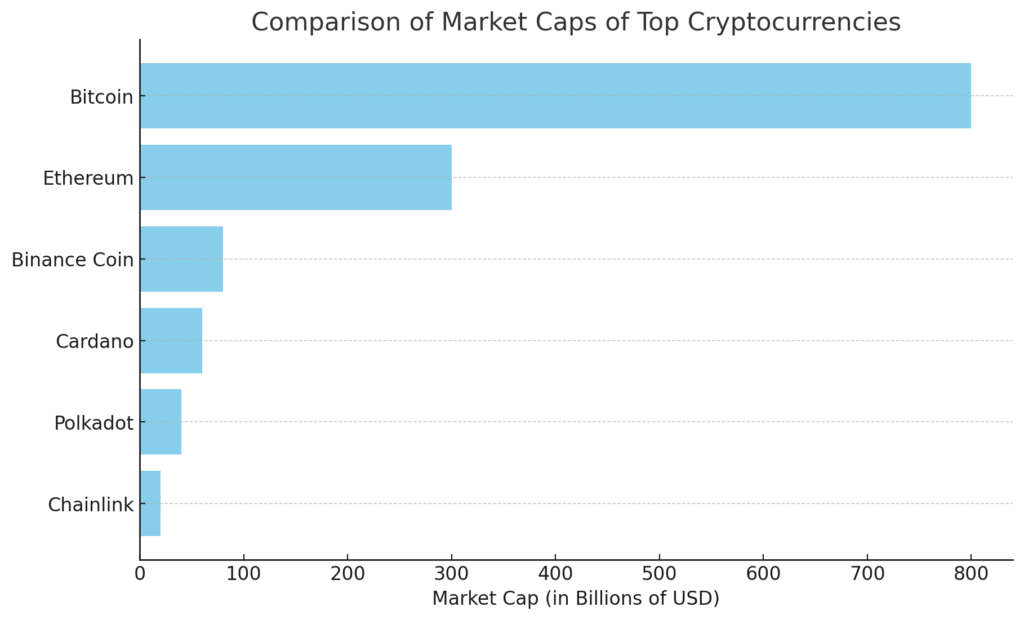

For instance, Bitcoin and Ethereum, which consistently rank at the top in terms of market cap, are seen as safer investments due to their widespread adoption, strong development teams, and robust infrastructure. On the other hand, cryptocurrencies with lower market caps can offer higher returns but come with increased risk due to their volatility and lower liquidity.

Classifying Cryptocurrencies by Market Capitalization

Cryptocurrencies are often classified into three main categories based on their market cap:

- Large-Cap Cryptocurrencies: These are well-established cryptocurrencies with a market cap exceeding $10 billion. They are considered more stable and are typically the top choices for conservative investors.

- Mid-Cap Cryptocurrencies: With a market cap between $1 billion and $10 billion, these cryptocurrencies offer a balance between risk and reward. They have the potential for significant growth but are less stable than large-cap coins.

- Small-Cap Cryptocurrencies: These have a market cap of less than $1 billion. They are the riskiest but can offer substantial returns if they gain traction in the market.

Assessing Market Cap for 2025 Investments

When evaluating potential Top Cryptocurrency Investments for 2025, looking at the market cap can help you identify which coins are likely to withstand market fluctuations and continue growing. It’s essential to consider whether the market cap is backed by solid fundamentals, such as active development, strong use cases, and growing adoption.

Technology and Blockchain

The technology and underlying blockchain behind a cryptocurrency are critical factors to consider when evaluating Top Cryptocurrency Investments for 2025. Blockchain is the foundational technology that powers cryptocurrencies, enabling secure, transparent, and decentralized transactions. Understanding the intricacies of a cryptocurrency’s blockchain can provide insights into its potential for growth, scalability, and adoption.

Understanding Blockchain Technology

At its core, a blockchain is a distributed ledger that records all transactions across a network of computers. This decentralized nature ensures that no single entity has control over the entire network, making it highly secure and resistant to tampering. Each transaction is grouped into blocks, which are then linked together in a chain, hence the name “blockchain.”

The blockchain’s ability to operate without a central authority is one of the primary reasons it has gained widespread attention. For investors, a strong, well-designed blockchain can indicate the potential for long-term success and stability in a cryptocurrency.

Key Blockchain Features to Consider

When evaluating the Top Cryptocurrency Investments for 2025, consider the following key features of blockchain technology:

- Scalability: Scalability refers to the blockchain’s ability to handle an increasing number of transactions. Cryptocurrencies like Ethereum are working on scaling solutions such as sharding and Layer 2 protocols to improve transaction speed and reduce costs.

- Security: The security of a blockchain is paramount. Look for cryptocurrencies that utilize advanced cryptographic techniques, consensus mechanisms like Proof of Stake (PoS) or Proof of Work (PoW), and have a history of resisting attacks.

- Smart Contract Functionality: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Ethereum, for example, was the first blockchain to introduce this functionality, enabling decentralized applications (dApps) and driving widespread adoption.

- Energy Efficiency: With increasing concerns over the environmental impact of cryptocurrency mining, energy-efficient blockchains are becoming more attractive. Cryptocurrencies that use PoS or other low-energy consensus mechanisms are likely to be favored by environmentally conscious investors.

- Interoperability: The ability of a blockchain to interact with other blockchains is known as interoperability. Projects like Polkadot and Cosmos focus on enabling different blockchains to communicate and transfer assets seamlessly, which could be a significant factor in their future growth.

Evaluating Blockchain Technology for 2025 Investments

As you assess the Top Cryptocurrency Investments for 2025, understanding the strengths and weaknesses of the underlying blockchain technology is crucial. A cryptocurrency with a scalable, secure, and efficient blockchain is more likely to withstand market pressures and achieve long-term success. Additionally, innovations in smart contracts, interoperability, and energy efficiency can significantly enhance a cryptocurrency’s value proposition.

Use Case and Adoption

When evaluating the Top Cryptocurrency Investments for 2025, the use case and level of adoption are crucial factors that can significantly impact the long-term success of a cryptocurrency. A strong use case demonstrates the practical applications of a cryptocurrency, while widespread adoption indicates trust and acceptance within the market.

What Is a Use Case?

A use case refers to the specific problem or need that a cryptocurrency aims to address. Different cryptocurrencies are designed to serve various purposes, ranging from facilitating fast and low-cost transactions to enabling decentralized finance (DeFi) and powering smart contracts. The more relevant and impactful the use case, the higher the likelihood of the cryptocurrency gaining traction and value over time.

Common Cryptocurrency Use Cases

- Digital Payments: Cryptocurrencies like Bitcoin and Litecoin were initially created as alternatives to traditional fiat currencies, enabling peer-to-peer digital payments without the need for intermediaries like banks. Their primary use case is as a store of value and a medium of exchange.

- Smart Contracts and Decentralized Applications (dApps): Ethereum is the pioneer in this area, providing a platform for developers to build decentralized applications that run on smart contracts. This use case has led to the rise of decentralized finance (DeFi), non-fungible tokens (NFTs), and more, making Ethereum a cornerstone in the blockchain ecosystem.

- Privacy and Security: Cryptocurrencies like Monero and Zcash focus on enhancing user privacy by offering untraceable and anonymous transactions. Their use case appeals to those who prioritize security and confidentiality in their financial activities.

- Supply Chain Management: VeChain is an example of a cryptocurrency designed to improve supply chain transparency and efficiency. Its blockchain-based platform allows for real-time tracking and verification of goods, ensuring authenticity and reducing fraud.

- Interoperability: Cryptocurrencies like Polkadot and Cosmos are designed to enable different blockchains to interact and share information. This use case is vital for creating a more connected and efficient blockchain ecosystem.

The Importance of Adoption

Adoption refers to the extent to which a cryptocurrency is used and accepted by individuals, businesses, and institutions. High adoption rates indicate a cryptocurrency’s viability and trust within the market, which can lead to increased demand and, consequently, a higher market value.

For example, Bitcoin’s widespread adoption as a digital asset and store of value has solidified its position as “digital gold,” making it a staple in many investment portfolios. Similarly, Ethereum’s adoption for smart contracts and dApps has driven its growth and positioned it as the leading platform for decentralized applications.

Factors Driving Adoption

- Partnerships and Collaborations: Strategic partnerships with well-known companies and institutions can boost a cryptocurrency’s credibility and adoption. For instance, collaborations between blockchain projects and major financial institutions can lead to increased usage and acceptance.

- Regulatory Support: Favorable regulations can encourage adoption by providing a clear legal framework for the use of cryptocurrencies. Conversely, regulatory uncertainty can hinder adoption by creating risks for investors and users.

- Community and Developer Support: A strong and active community, coupled with ongoing developer contributions, can drive innovation and adoption. Cryptocurrencies with vibrant communities and a steady stream of updates and improvements are more likely to succeed in the long term.

- Ease of Use: The more user-friendly a cryptocurrency is, the more likely it is to be adopted by the general public. Simple interfaces, easy access to wallets, and seamless integration with existing financial systems can all contribute to higher adoption rates.

Evaluating Use Case and Adoption for 2025 Investments

As you consider the Top Cryptocurrency Investments for 2025, it’s essential to assess both the use case and current adoption levels. A cryptocurrency with a strong, relevant use case and growing adoption is more likely to thrive in the coming years. Look for projects that address real-world problems and have a clear path to increasing their user base and market penetration.

Partnerships & Collaborations

In the world of cryptocurrency, partnerships and collaborations play a pivotal role in the success and growth of a project. When evaluating the Top Cryptocurrency Investments for 2025, it’s crucial to consider the strategic alliances that a cryptocurrency has formed, as these can significantly influence its adoption, development, and overall market value.

Why Partnerships and Collaborations Matter

Partnerships and collaborations can provide a cryptocurrency with the resources, expertise, and market access needed to achieve its goals. These alliances can take many forms, including:

- Technological Collaborations: Collaborating with technology companies or other blockchain projects can help a cryptocurrency enhance its capabilities. For example, a partnership with a tech giant could lead to improvements in scalability, security, or user experience.

- Industry Partnerships: Forming alliances with businesses across various industries can drive real-world use cases for a cryptocurrency. For instance, a partnership with a major retail chain could enable cryptocurrency payments, increasing its adoption and utility.

- Financial Partnerships: Collaborations with financial institutions, such as banks or payment processors, can facilitate the integration of cryptocurrency into traditional financial systems. This can make it easier for users to buy, sell, and use the cryptocurrency in their everyday lives.

- Government and Regulatory Collaborations: Working with governments or regulatory bodies can provide a cryptocurrency with legal clarity and support, reducing regulatory risks and encouraging broader adoption.

Examples of Successful Partnerships in Cryptocurrency

- Ripple (XRP): Ripple has established numerous partnerships with banks and financial institutions worldwide, aiming to revolutionize cross-border payments. Its collaboration with companies like Santander and American Express has strengthened its position as a leading cryptocurrency for global money transfers.

- Chainlink (LINK): Chainlink’s partnerships with various blockchain projects and tech companies have cemented its role as a leading decentralized oracle network. Collaborations with platforms like Google Cloud and Oracle have expanded Chainlink’s reach and utility in the smart contract ecosystem.

- VeChain (VET): VeChain’s partnerships with major companies like Walmart China and BMW have driven its adoption in supply chain management. These alliances have enabled VeChain to showcase its blockchain’s ability to enhance transparency and efficiency in global supply chains.

- Ethereum (ETH): Ethereum has benefited from widespread collaboration with developers, businesses, and governments. The Ethereum Enterprise Alliance, which includes companies like Microsoft and Intel, has promoted the adoption of Ethereum for enterprise blockchain solutions.

Evaluating Partnerships for 2025 Investments

When assessing the Top Cryptocurrency Investments for 2025, consider the quality and scope of a cryptocurrency’s partnerships. Strong, strategic alliances can provide the following benefits:

- Increased Adoption: Partnerships with well-known companies can drive broader adoption by making the cryptocurrency more accessible and useful in everyday life.

- Enhanced Credibility: Collaborations with reputable organizations can boost a cryptocurrency’s credibility, attracting more investors and users.

- Innovation and Development: Technological collaborations can lead to innovations that improve the cryptocurrency’s functionality, security, and scalability.

- Market Expansion: Partnerships can open up new markets and user bases, increasing the cryptocurrency’s global reach and potential for growth.

Regulatory Environment

The regulatory environment surrounding cryptocurrencies is one of the most critical factors to consider when evaluating the Top Cryptocurrency Investments for 2025. As the cryptocurrency market continues to evolve, governments and regulatory bodies worldwide are developing frameworks to govern its use, trading, and adoption. Understanding the current and potential regulatory landscape is essential for making informed investment decisions.

Why the Regulatory Environment Matters

Cryptocurrencies operate in a complex and often uncertain regulatory landscape. Regulations can impact various aspects of a cryptocurrency, including its legality, market access, and even its price. A favorable regulatory environment can encourage adoption and growth, while restrictive regulations can hinder development and limit a cryptocurrency’s potential.

For investors, staying informed about the regulatory environment is crucial because:

- Legal Compliance: Ensuring that a cryptocurrency complies with existing regulations can protect investors from legal risks and potential penalties. Compliance also enhances the credibility of the cryptocurrency, attracting more users and institutional investors.

- Market Stability: Regulatory clarity can lead to greater market stability. When governments provide clear guidelines, it reduces uncertainty, which can decrease market volatility and encourage long-term investment.

- Innovation and Development: A supportive regulatory environment can foster innovation by providing a clear framework for developers and businesses to operate within. This can lead to the creation of new products and services, driving further adoption of the cryptocurrency.

- Global Adoption: Cryptocurrencies that operate in multiple jurisdictions must navigate different regulatory landscapes. Those that can achieve compliance across various regions are more likely to see global adoption and long-term success.

Key Regulatory Factors to Consider

When evaluating the Top Cryptocurrency Investments for 2025, consider the following regulatory factors:

- Government Stance: The attitude of governments toward cryptocurrencies varies widely. Some countries, like Japan and Switzerland, have embraced cryptocurrencies, creating a supportive regulatory environment. Others, like China, have imposed strict regulations or outright bans. Understanding the stance of key governments can help predict how regulations might evolve.

- Taxation Policies: Taxation of cryptocurrency transactions and holdings can significantly impact investor returns. Countries differ in how they tax cryptocurrencies, with some treating them as property and others as currency. Investors should be aware of the tax implications in their jurisdictions.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements: Many countries require cryptocurrency exchanges and businesses to implement AML and KYC measures. These regulations aim to prevent illegal activities but can also affect the ease of use and accessibility of cryptocurrencies.

- Securities Classification: The classification of cryptocurrencies as securities can have significant regulatory implications. In the U.S., for example, the Securities and Exchange Commission (SEC) has taken action against projects that it deems to have violated securities laws. Understanding how a cryptocurrency is classified can help assess its regulatory risk.

- International Coordination: As cryptocurrencies are global by nature, international regulatory coordination is becoming increasingly important. Initiatives like the Financial Action Task Force (FATF) guidelines aim to harmonize regulations across countries, which could lead to a more predictable and stable regulatory environment.

Evaluating the Regulatory Environment for 2025 Investments

As you consider the Top Cryptocurrency Investments for 2025, it’s essential to assess the regulatory environment in which each cryptocurrency operates. Look for projects that have demonstrated a commitment to compliance and have navigated regulatory challenges successfully. Additionally, consider how potential changes in regulations might impact the cryptocurrency’s future growth and adoption.

Investors should also stay informed about ongoing regulatory developments, as the landscape can change rapidly. Being proactive in understanding and responding to these changes can help mitigate risks and capitalize on opportunities.

Investment Potential and ROI

When evaluating the Top Cryptocurrency Investments for 2025, one of the most crucial aspects to consider is the investment potential and return on investment (ROI). Understanding the potential for growth and the risks involved can help investors make informed decisions about where to allocate their funds for the best possible returns.

What Is Investment Potential?

Investment potential refers to the likelihood that a cryptocurrency will increase in value over time, providing investors with a profit. Several factors contribute to a cryptocurrency’s investment potential, including its market adoption, technological innovation, development team, and overall market trends. The greater the potential for growth, the more attractive the cryptocurrency is as an investment.

Key Factors Influencing Investment Potential

- Market Demand: A cryptocurrency with strong market demand is more likely to see its value rise. Demand can be driven by factors such as widespread adoption, real-world use cases, and positive market sentiment. For instance, cryptocurrencies that solve significant problems or offer unique features tend to attract more investors.

- Technological Innovation: Cryptocurrencies that are at the forefront of technological advancements often have higher investment potential. Innovations such as smart contracts, scalability solutions, and interoperability can enhance a cryptocurrency’s value proposition and attract long-term investors.

- Scarcity and Supply: The total supply of a cryptocurrency can also impact its investment potential. Cryptocurrencies with a limited supply, like Bitcoin, can become more valuable over time as demand increases. The scarcity of the asset can drive up its price, especially during periods of high demand.

- Market Sentiment and Trends: The overall sentiment in the cryptocurrency market can significantly influence the investment potential of individual cryptocurrencies. Positive trends, such as increased institutional investment or mainstream acceptance, can boost confidence and drive up prices.

- Development Team and Roadmap: A strong development team with a clear, achievable roadmap can enhance a cryptocurrency’s investment potential. Investors should look for projects with active development, frequent updates, and a transparent plan for future growth.

Understanding ROI in Cryptocurrency Investments

Return on Investment (ROI) is a measure of the profitability of an investment, expressed as a percentage. It is calculated by comparing the current value of the investment to its original cost. In the context of cryptocurrency, ROI can be highly volatile due to the market’s inherent fluctuations.

For example, if an investor buys a cryptocurrency at $1,000 and its value increases to $1,500, the ROI would be 50%. However, if the value drops to $800, the ROI would be negative (-20%).

Evaluating ROI for 2025 Cryptocurrency Investments

When considering the Top Cryptocurrency Investments for 2025, it’s essential to evaluate the potential ROI based on historical performance, current market trends, and future projections. Here are some steps to help assess the ROI:

- Historical Performance: Review the historical price trends of the cryptocurrency. While past performance is not always indicative of future results, it can provide insights into the asset’s volatility and resilience in different market conditions.

- Risk vs. Reward: Higher potential ROI often comes with higher risk. It’s important to assess your risk tolerance and consider whether the potential rewards justify the risks. Cryptocurrencies with lower market caps might offer higher ROI but are also more prone to extreme volatility.

- Time Horizon: Consider your investment time horizon. Cryptocurrencies can experience significant short-term fluctuations, so a long-term perspective might be necessary to realize substantial returns. Some cryptocurrencies may require years to achieve their full potential.

- Market Conditions: The broader market conditions can greatly influence ROI. Bull markets often lead to higher returns, while bear markets can result in negative ROI. Understanding the current market cycle can help you time your investments better.

- Diversification: To manage risk, consider diversifying your cryptocurrency investments. Investing in a mix of large-cap, mid-cap, and small-cap cryptocurrencies can help balance potential ROI with risk.

Conclusion

As we look ahead to 2025, the cryptocurrency market presents a landscape rich with opportunities and challenges. Investing in cryptocurrencies requires a careful evaluation of multiple factors, including market capitalization, underlying technology, use cases, partnerships, regulatory environment, and the potential for ROI. By considering these aspects, investors can identify the Top Cryptocurrency Investments for 2025: Best Coins to Consider for Long-Term Gains.

In this rapidly evolving space, staying informed and adaptable is key. The cryptocurrencies that demonstrate strong fundamentals, technological innovation, widespread adoption, and strategic partnerships are likely to lead the market in the coming years. However, it’s important to remember that the cryptocurrency market is inherently volatile, and with high rewards often come high risks.

As you plan your investment strategy for 2025, focus on a diversified portfolio that balances potential returns with your risk tolerance. Keep an eye on regulatory developments, technological advancements, and market trends to stay ahead of the curve. By doing so, you can position yourself to capitalize on the most promising opportunities in the cryptocurrency market.

Investing in cryptocurrencies can be a rewarding journey, but it requires diligence, research, and a long-term perspective. With the right approach, you can navigate the complexities of the market and achieve your financial goals in the exciting world of digital assets.