Introduction

The stock market is a cornerstone of the global economy, allowing investors to buy and sell shares of companies and participate in their growth. It offers a platform where businesses raise capital, and investors can potentially earn returns on their investments. For many, the stock market represents an opportunity to build wealth, diversify their financial portfolio, and secure their financial future.

Understanding the basics of the stock market is essential, whether you’re just starting or looking to refine your investment strategy. The market’s ups and downs can seem intimidating, but with a solid grasp of how it works, you can make informed decisions that align with your financial goals. Investing in the stock market isn’t just for experts; it’s accessible to anyone willing to learn and take a strategic approach.

What is the Stock Market?

The stock market is a marketplace where investors buy and sell shares of publicly traded companies. It operates through exchanges like the New York Stock Exchange (NYSE) and NASDAQ, where stocks are listed and traded. The stock market enables companies to raise capital by issuing shares to the public, while investors can gain ownership stakes in these companies, hoping to profit from price increases and dividends.

At its core, the stock market reflects the overall health of the economy, with stock prices influenced by factors such as company performance, economic data, and investor sentiment. The market is divided into primary and secondary markets. In the primary market, companies issue new shares through initial public offerings (IPOs). In the secondary market, investors trade these shares among themselves.

Participating in the stock market allows individuals to invest in various sectors and industries, making it a versatile tool for achieving long-term financial goals. Whether you’re investing in large, established companies or exploring new opportunities, understanding the fundamentals of the stock market is the first step toward making informed investment choices.

History of the Stock Market

The stock market has a rich history that dates back to the early 17th century when the first official stock exchange was established in Amsterdam. It all began with the Dutch East India Company, which issued the first shares of stock to raise funds for its trading ventures. This marked the birth of the stock market as a way for companies to raise capital and for investors to share in the profits.

In the centuries that followed, stock markets spread across Europe and eventually to the United States, with the New York Stock Exchange (NYSE) being founded in 1792. The NYSE became the largest stock market in the world, setting the stage for the modern era of investing. Over time, technological advancements and regulatory changes have transformed the stock market, making it more accessible to the general public.

The stock market has seen its share of highs and lows, from the boom of the Roaring Twenties to the devastating crash of 1929 that led to the Great Depression. More recent events, such as the 2008 financial crisis and the COVID-19 pandemic, have also significantly impacted market behavior. Despite these challenges, the stock market has continued to evolve, offering investors a platform to participate in economic growth.

Today, the stock market plays a vital role in the global economy, allowing individuals and institutions to invest in a wide array of industries. Understanding its history helps investors appreciate the resilience of the market and the opportunities it presents, reinforcing why the stock market remains a powerful tool for building wealth.

How the Stock Market Works

The stock market works as a platform where buyers and sellers come together to trade shares of publicly listed companies. It operates through stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ, where these transactions take place. The stock market functions through a network of exchanges that facilitate the buying and selling of stocks, ensuring a fair and orderly market.

When a company wants to raise money, it can go public by issuing shares through an Initial Public Offering (IPO). Once the shares are issued, they are traded on the stock market, allowing investors to buy and sell them based on supply and demand. Prices of stocks are influenced by various factors, including company performance, economic indicators, and overall market sentiment.

Stock prices fluctuate throughout the trading day, driven by news, earnings reports, and investor speculation. Traders use different strategies to take advantage of these price movements, while long-term investors typically buy and hold stocks to benefit from company growth over time.

To participate in the stock market, investors typically use a brokerage account, which serves as an intermediary between them and the exchanges. Through this account, investors can place orders to buy or sell stocks, which are then executed on the stock exchange.

The stock market is governed by strict regulations to protect investors and maintain market integrity. Organizations like the Securities and Exchange Commission (SEC) in the United States oversee the market, ensuring transparency and fairness.

Understanding how the stock market works is essential for making informed investment decisions. By knowing the basics of buying, selling, and the factors that influence prices, investors can better navigate the market and work toward achieving their financial goals.

Key Players in the Stock Market

The stock market is a complex ecosystem involving various key players, each playing a distinct role in ensuring its smooth operation. Understanding who these players are and what they do can help you grasp how the stock market functions.

- Retail Investors: These are individual investors like you and me who buy and sell stocks through personal brokerage accounts. Retail investors are a significant force in the stock market, influencing stock prices through collective buying and selling decisions.

- Institutional Investors: Institutional investors include entities like mutual funds, pension funds, insurance companies, and hedge funds. They manage large sums of money and often make significant investments, which can greatly impact stock prices. Due to their size and resources, institutional investors have access to research and tools that individual investors may not.

- Brokers and Brokerage Firms: Brokers act as intermediaries between investors and the stock market. They execute buy and sell orders on behalf of their clients and provide platforms for trading. Brokerage firms can be full-service, offering investment advice and research, or discount brokers, focusing on low-cost trades with minimal guidance.

- Market Makers: Market makers are firms or individuals that provide liquidity to the stock market by buying and selling shares from their inventory. They play a crucial role in ensuring that there is always a buyer and a seller for stocks, thus maintaining the flow of trading.

- Regulators: Regulators, such as the Securities and Exchange Commission (SEC) in the U.S., oversee the stock market to maintain fair, transparent, and orderly trading. They enforce rules and regulations to protect investors and ensure the market operates with integrity.

- Company Executives: Company executives and insiders, such as CEOs and board members, play a role by making decisions that directly affect their company’s stock price. Insider trading regulations require that their trades are publicly reported, as they often signal confidence or concern about the company’s future.

- Financial Analysts and Advisors: Analysts provide research and recommendations on stocks, helping investors make informed decisions. Financial advisors offer personalized advice based on an investor’s financial goals, risk tolerance, and market conditions.

Types of Stocks and Investments

The stock market offers a variety of stocks and investment options that cater to different investor needs and strategies. Understanding the different types can help you make informed decisions about where to put your money.

- Common Stocks: These are the most widely traded stocks in the stock market, representing ownership in a company. Common stockholders have voting rights in company decisions and can benefit from dividends and capital gains. However, they are last in line to receive assets if the company goes bankrupt.

- Preferred Stocks: Preferred stocks offer a fixed dividend and have a higher claim on assets than common stocks, but they typically do not come with voting rights. They combine features of both stocks and bonds, making them an attractive option for investors seeking steady income.

- Growth Stocks: Growth stocks belong to companies expected to grow at an above-average rate compared to other companies in the market. These stocks often reinvest their earnings into expansion rather than paying dividends, making them ideal for investors looking for long-term capital appreciation.

- Value Stocks: Value stocks are shares of companies that are considered undervalued based on their financial performance and market price. They often pay dividends and are seen as a good option for investors seeking steady returns with lower risk compared to growth stocks.

- Dividend Stocks: Dividend stocks are shares that pay regular dividends to shareholders, providing a steady income stream. They are popular among income-focused investors, such as retirees, who prefer reliable payouts over capital gains.

- Blue-Chip Stocks: These are shares of large, well-established companies with a history of reliable performance and dividends. Blue-chip stocks are often seen as safer investments, providing stability in volatile markets.

- Penny Stocks: Penny stocks are low-priced stocks, typically trading below $5 per share. They are often highly speculative and come with higher risks but can offer substantial returns for investors willing to take on more risk.

- ETFs (Exchange-Traded Funds): ETFs are investment funds that hold a basket of stocks and trade on stock exchanges like individual stocks. They offer diversification and are popular among investors looking for exposure to specific sectors, indices, or asset classes without picking individual stocks.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds offer diversification and professional management, making them suitable for investors who prefer a hands-off approach.

Benefits of Investing in the Stock Market

Investing in the stock market offers numerous benefits, making it an attractive option for those looking to grow their wealth and achieve financial goals. Here are some key advantages of investing in the stock market:

- Potential for High Returns: One of the main benefits of the stock market is the potential for high returns compared to other investment options like bonds or savings accounts. Stocks have historically outperformed most asset classes over the long term, providing investors with the opportunity to build substantial wealth.

- Dividend Income: Many companies pay dividends to shareholders, offering a regular income stream in addition to any capital gains. Dividend stocks can provide a steady source of passive income, which can be reinvested or used as cash flow, especially valuable for retirees.

- Diversification Opportunities: The stock market allows investors to diversify their portfolios by investing in a wide range of industries, sectors, and geographic regions. Diversification helps spread risk, reducing the impact of a downturn in any single investment.

- Ownership in Companies: When you invest in stocks, you gain partial ownership in the companies you buy shares of. This means you can benefit directly from the company’s growth, profits, and success over time.

- Liquidity: Stocks are considered a highly liquid asset because they can be easily bought and sold on the stock market during trading hours. This liquidity provides flexibility, allowing investors to quickly adjust their positions in response to market changes or personal financial needs.

- Inflation Hedge: Investing in the stock market can act as a hedge against inflation. Over time, the value of stocks tends to increase at a rate that outpaces inflation, helping preserve and grow your purchasing power.

- Access to a Wide Range of Investment Strategies: The stock market offers access to various investment strategies, from conservative approaches focused on blue-chip stocks and dividends to more aggressive strategies like growth and value investing. This flexibility allows investors to tailor their portfolios to meet their specific financial objectives.

- Compounding Gains: Reinvesting your dividends and gains allows you to benefit from the power of compounding. This means your investment grows not just from the original amount but also from the accumulated earnings, accelerating wealth-building over time.

- Low Barriers to Entry: With the rise of online brokerage platforms, investing in the stock market has become more accessible than ever. Even small amounts can be invested, making it possible for nearly anyone to participate and start building a portfolio.

Risks Involved in the Stock Market

While investing in the stock market offers significant opportunities for growth, it also comes with various risks that investors need to be aware of. Understanding these risks can help you make more informed decisions and better manage your investments.

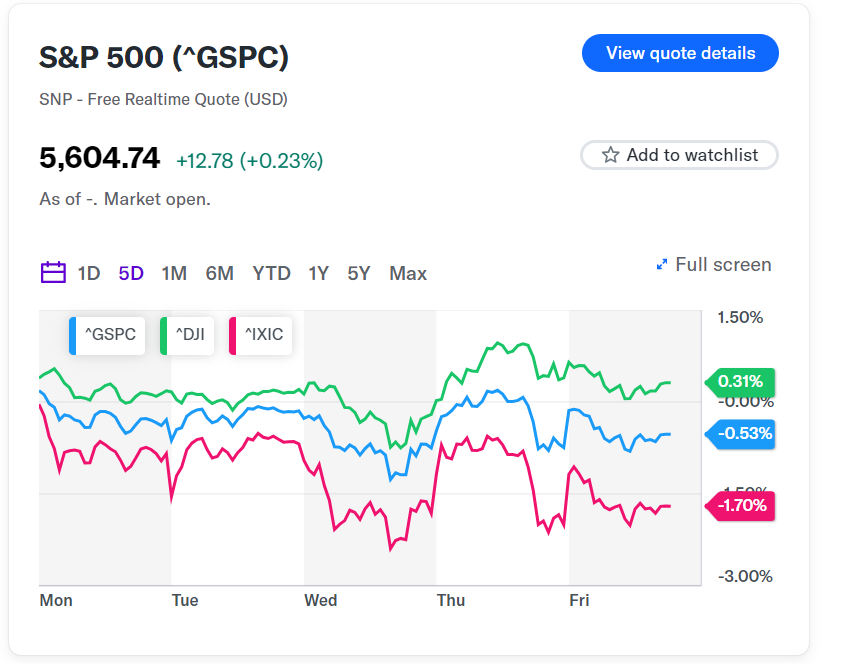

- Market Volatility: The stock market is known for its fluctuations, with prices often changing rapidly due to economic data, company earnings, or global events. This volatility can lead to sudden drops in stock prices, impacting your investment’s value, especially in the short term.

- Economic and Political Factors: The stock market is influenced by broader economic and political conditions, such as interest rates, inflation, and government policies. Economic downturns or political instability can lead to market declines, affecting your investments.

- Company-Specific Risks: Investing in individual stocks means you are directly exposed to the performance of specific companies. Poor management decisions, financial misstatements, or industry challenges can significantly impact a company’s stock price, posing a direct risk to your investment.

- Liquidity Risk: While many stocks are highly liquid, some, especially smaller or less frequently traded stocks, can be difficult to buy or sell quickly without affecting the price. This liquidity risk can make it challenging to exit your position at your desired price.

- Timing Risk: Timing the stock market is notoriously difficult. Attempting to buy low and sell high can lead to missed opportunities or losses if your timing is off. Market timing requires careful analysis and often relies on factors that are beyond an investor’s control.

- Inflation Risk: Although the stock market can act as a hedge against inflation, there are times when inflation outpaces stock returns, eroding the purchasing power of your investments. High inflation can impact company profits, leading to lower stock prices.

- Emotional Investing: Emotional reactions, such as fear during market downturns or greed during booms, can lead to poor investment decisions. Emotional investing often results in buying high and selling low, which can negatively impact long-term returns.

- Interest Rate Risk: Changes in interest rates can influence stock prices, particularly for companies that rely heavily on borrowing. Rising interest rates can increase borrowing costs, reduce consumer spending, and negatively affect stock valuations.

- Regulatory and Legal Risks: Changes in regulations, tax laws, or legal issues can affect certain industries or companies. These risks can lead to sudden changes in stock prices, especially if new laws impact a company’s profitability or business model.

Tips for Successful Stock Market Investing

Investing in the stock market can be rewarding, but it requires knowledge, strategy, and discipline. Whether you’re a beginner or an experienced investor, following some key tips can help you navigate the stock market successfully and achieve your financial goals.

- Diversify Your Portfolio: One of the most effective ways to manage risk in the stock market is by diversifying your investments. Spread your money across different sectors, industries, and asset classes to reduce the impact of a downturn in any single investment.

- Invest for the Long Term: The stock market can be volatile in the short term, but it has historically trended upward over the long run. Staying invested and focusing on long-term growth can help you ride out market fluctuations and benefit from compounding gains.

- Do Your Research: Before investing in any stock, take the time to research the company, its financial health, and industry trends. Understanding what you’re investing in will help you make more informed decisions and avoid speculative bets.

- Set Clear Financial Goals: Define your investment objectives, whether it’s saving for retirement, buying a home, or building wealth. Having clear goals will help you choose the right investments and stay focused on your financial plan.

- Avoid Emotional Investing: Stock market investing can trigger emotions like fear during downturns or excitement during booms. Avoid making impulsive decisions based on market movements. Stick to your investment strategy and remain patient.

- Stay Updated on Market Trends: Keeping up with the latest market news, economic data, and company earnings reports can help you make better investment decisions. Staying informed allows you to adjust your strategy in response to changing market conditions.

- Start Small and Gradually Increase Your Investments: If you’re new to the stock market, start with small investments to gain experience and confidence. As you become more comfortable, you can gradually increase your investment amounts.

- Reinvest Dividends: Reinvesting dividends can significantly boost your returns over time by harnessing the power of compounding. Many brokerage accounts offer automatic dividend reinvestment options, allowing your money to grow faster.

- Have a Risk Management Plan: Assess your risk tolerance and choose investments that match your comfort level. Use stop-loss orders, diversify your holdings, and consider risk-reducing strategies to protect your portfolio from significant losses.

- Consult with a Financial Advisor: If you’re unsure about navigating the stock market, consulting with a financial advisor can provide personalized guidance. Advisors can help you create a tailored investment plan and offer insights based on your unique financial situation.

Conclusion

Investing in the stock market can be a powerful way to grow your wealth, achieve financial independence, and meet your long-term financial goals. While the stock market comes with its risks, understanding how it works, recognizing the key players, and knowing the types of investments available can help you navigate it confidently. The potential rewards of the stock market, such as high returns, dividend income, and portfolio diversification, make it an essential component of any investment strategy.

To succeed in the stock market, it’s important to stay informed, invest with a long-term perspective, and manage your risks effectively. By following practical tips, such as diversifying your investments, avoiding emotional decisions, and setting clear financial goals, you can make the most of the opportunities that the stock market offers.

Whether you’re just starting or looking to enhance your existing strategy, taking the time to learn and apply sound investing principles will help you build a solid foundation for future success. The stock market is more than just a place to buy and sell stocks—it’s a pathway to financial growth and security. Start your journey with confidence, and remember that every successful investor begins with a single step: understanding the stock market.