Introduction to Nvidia as a Stock Investment

Nvidia has emerged as a powerhouse in the tech world, making it a compelling choice for stock investors. As a global leader in graphics processing units (GPUs), Nvidia plays a critical role in various high-growth sectors such as gaming, data centers, artificial intelligence (AI), and autonomous vehicles. For Nvidia stock investors, understanding the company’s impact across these industries is crucial for gauging its potential as a long-term investment.

Founded in 1993, Nvidia initially focused on graphics cards for gaming. However, it quickly diversified into broader applications, becoming a major player in the AI and data center markets. Today, Nvidia’s GPUs are considered the gold standard for high-performance computing, which powers everything from AI research to cryptocurrency mining. This versatility makes Nvidia stock particularly attractive to investors looking for exposure to multiple technology trends.

Another key factor that draws Nvidia stock investors is the company’s robust financial performance. Over the past several years, Nvidia has demonstrated impressive revenue growth, driven by both its core gaming market and its expansion into data centers and AI. The company continues to deliver strong quarterly earnings, even amid global supply chain disruptions, signaling a resilient business model.

For potential Nvidia stock investors, the company’s ability to innovate and maintain its competitive edge is a significant selling point. Nvidia consistently invests in research and development, ensuring it stays ahead of the curve in fast-evolving tech markets. With a strong balance sheet and a commitment to innovation, Nvidia is well-positioned to capture future growth opportunities.

Nvidia’s Financial Performance and Earnings Growth

For Nvidia stock investors, the company’s financial performance and earnings growth are critical factors that highlight its strong position in the market. Nvidia has consistently posted robust financial results, reflecting its dominance in the GPU market and its strategic expansion into high-growth sectors like AI, data centers, and autonomous vehicles.

Over recent years, Nvidia has shown impressive revenue growth. In the last fiscal year, the company reported a significant increase in revenue, driven largely by demand for its GPUs in gaming, data centers, and AI applications. The gaming segment continues to be a core revenue driver, but it’s Nvidia’s data center business that has seen the most rapid growth, contributing a larger share of total revenue each quarter. This diversification across multiple sectors provides a balanced revenue stream, reducing dependency on any single market.

Nvidia has also maintained healthy profit margins, showcasing its ability to control costs while scaling its operations. The company’s gross margin has consistently stayed above 60%, reflecting strong pricing power and operational efficiency. This is an encouraging sign for Nvidia stock investors, as it demonstrates the company’s capacity to generate profits even in a competitive market environment.

In terms of earnings, Nvidia has delivered steady growth, with double-digit increases in earnings per share (EPS) over the past several quarters. The company’s earnings growth has been fueled not only by rising revenues but also by strategic cost management and continuous investment in innovation. For Nvidia stock investors, this consistent EPS growth signals that the company is not only expanding its market presence but also effectively managing its bottom line.

Looking ahead, Nvidia has provided optimistic guidance for future quarters, expecting continued revenue growth driven by sustained demand in gaming and AI markets, as well as emerging opportunities in the automotive sector. For Nvidia stock investors, this positive outlook suggests that the company is well-positioned to capitalize on its strengths and navigate any potential market challenges.

Market Potential and Growth Drivers for Nvidia

For Nvidia stock investors, understanding the market potential and key growth drivers is crucial to evaluating the company’s future prospects. Nvidia operates at the forefront of several rapidly growing industries, making it a compelling investment opportunity.

One of the most significant growth drivers for Nvidia is its leadership in artificial intelligence (AI). Nvidia’s GPUs are widely recognized as the standard for AI development, powering everything from deep learning algorithms to AI research in universities and tech companies worldwide. As AI adoption continues to accelerate across industries, Nvidia is positioned to benefit from increasing demand for its high-performance computing solutions.

The gaming sector remains another strong growth area for Nvidia. As the creator of some of the most powerful GPUs, Nvidia has a dominant share in the gaming hardware market. With gaming becoming more mainstream and the rise of trends like esports, cloud gaming, and virtual reality (VR), demand for Nvidia’s GPUs is expected to grow further. For Nvidia stock investors, this sustained interest in gaming provides a steady revenue stream.

Data centers represent a particularly high-growth area for Nvidia. The shift toward cloud computing, big data, and enterprise AI applications has increased the demand for Nvidia’s data center products, which are critical for managing and processing vast amounts of information. The company’s recent collaborations and strategic partnerships with leading cloud service providers and tech giants further underscore its potential in this space.

Nvidia is also tapping into the automotive sector, specifically in autonomous driving and advanced driver-assistance systems (ADAS). Nvidia’s DRIVE platform is designed to support the development of self-driving cars, and its partnerships with leading automotive manufacturers signal significant future growth in this area. As the automotive industry evolves towards more autonomous and electric vehicles, Nvidia’s technology is expected to play a key role.

In addition to these sectors, Nvidia is exploring opportunities in the metaverse, a digital space where users interact in virtual environments. The company has introduced Omniverse, a platform designed to enable the creation and simulation of virtual worlds, which could be a significant revenue driver in the future.

Nvidia’s Product Portfolio and Innovation

For Nvidia stock investors, the company’s diverse product portfolio and commitment to innovation are key reasons behind its strong market position and continued growth. Nvidia’s products are at the cutting edge of technology, serving multiple high-growth industries such as gaming, artificial intelligence (AI), data centers, and automotive technology.

Core Products: GPUs and Beyond

Nvidia is best known for its Graphics Processing Units (GPUs), which have become the gold standard for gaming and professional visualization. The GeForce GPU series caters to gamers and PC enthusiasts, offering high performance for the latest games and virtual reality experiences. Meanwhile, the Quadro series is designed for professional applications in fields like architecture, media production, and scientific research. For Nvidia stock investors, the sustained demand for these GPUs underscores the company’s market dominance in graphics technology.

Beyond gaming, Nvidia has expanded its product portfolio to target other rapidly growing sectors. The Nvidia RTX series, based on the company’s advanced ray-tracing technology, has revolutionized graphics rendering by enabling real-time ray tracing and AI-powered features. This has further solidified Nvidia’s position as a leader in visual computing.

AI and Data Center Products

Nvidia’s AI and data center products represent a significant growth area for the company. Its Nvidia A100 Tensor Core GPUs are specifically designed for AI, data analytics, and high-performance computing. These GPUs are widely used in data centers around the world, providing the computational power needed for tasks such as deep learning, AI model training, and large-scale simulations. Nvidia’s DGX systems, which integrate multiple GPUs, are the foundation for many of the world’s AI supercomputers.

Additionally, Nvidia’s CUDA software platform supports its hardware products, enabling developers to optimize their applications for Nvidia GPUs. This comprehensive hardware and software ecosystem has made Nvidia the preferred choice for many enterprises investing in AI and machine learning, a fact that continues to attract Nvidia stock investors.

Automotive and Autonomous Driving Solutions

Nvidia is also pioneering innovation in the automotive industry with its Nvidia DRIVE platform, a comprehensive suite of hardware and software solutions designed for autonomous vehicles and advanced driver-assistance systems (ADAS). The platform includes Nvidia’s powerful GPUs, specialized AI chips, and software designed to handle complex tasks such as object detection, path planning, and real-time decision-making. Partnerships with major automakers, including Mercedes-Benz and Volvo, highlight the growing adoption of Nvidia’s automotive technology and present a significant opportunity for future revenue growth.

Metaverse and Omniverse Platform

Another innovative addition to Nvidia’s product portfolio is the Omniverse platform, which enables collaboration and simulation in virtual worlds. As interest in the metaverse grows, Nvidia’s Omniverse is positioned to become a leading tool for developers, content creators, and enterprises looking to build and operate in virtual environments. This new frontier represents a long-term growth opportunity for Nvidia and adds another layer of appeal for Nvidia stock investors.

Commitment to Innovation and Future Growth

Nvidia’s dedication to innovation is evident in its significant investment in research and development (R&D). The company continually pushes the boundaries of what its products can achieve, with a strong focus on AI, machine learning, and next-generation computing technologies. For Nvidia stock investors, this commitment to innovation is a reassuring sign of the company’s long-term growth potential and ability to maintain its competitive edge.

Risks and Challenges for Nvidia Stock Investors

While Nvidia offers significant growth potential, Nvidia stock investors should also be aware of the risks and challenges that could impact the company’s future performance. Understanding these risks is essential for making informed investment decisions.

1. Market Risks and Economic Uncertainty

Nvidia operates in a highly volatile technology market that is sensitive to broader economic conditions. Factors such as inflation, interest rate hikes, and global economic slowdowns can lead to reduced consumer spending, impacting demand for Nvidia’s products. For Nvidia stock investors, economic uncertainty poses a risk as it can affect the company’s revenue and profitability.

2. Supply Chain Disruptions

Like many technology companies, Nvidia relies on a complex global supply chain to produce its products. Disruptions in the supply chain, such as those caused by geopolitical tensions, natural disasters, or pandemic-related restrictions, can delay production and increase costs. Recent semiconductor shortages have already impacted Nvidia’s ability to meet demand. For Nvidia stock investors, supply chain risks can lead to fluctuations in stock price due to potential delays in product launches or missed revenue targets.

3. Intense Competition

Nvidia faces intense competition from several established players, including AMD, Intel, and other companies developing AI and data center solutions. These competitors are continuously innovating and introducing new products, which can impact Nvidia’s market share and pricing power. For Nvidia stock investors, increased competition could lead to pricing pressures, reduced margins, or a slowdown in market share growth.

4. Regulatory and Geopolitical Challenges

Nvidia operates globally, and its business can be affected by changes in government regulations, trade policies, and geopolitical tensions. For example, U.S. export restrictions on selling high-performance chips to China could limit Nvidia’s access to one of its largest markets. Additionally, proposed regulations around data privacy, AI, and autonomous vehicles could create compliance challenges. Nvidia stock investors should consider how such regulatory and geopolitical factors could impact the company’s growth prospects and market access.

5. Dependence on Key Markets

A significant portion of Nvidia’s revenue comes from key markets, such as gaming and data centers. Any slowdown or decline in these markets could directly impact Nvidia’s financial performance. For instance, if there is reduced consumer demand for gaming hardware or slower adoption of AI solutions by enterprises, Nvidia may face challenges in maintaining its growth trajectory. For Nvidia stock investors, this concentration risk should be considered when evaluating the stock’s long-term potential.

6. Technological Risks

Nvidia operates in a fast-evolving technological landscape where rapid innovation is crucial. The company must continually invest in research and development (R&D) to stay ahead of competitors and meet market demands. If Nvidia fails to innovate or if its new products do not perform as expected, it could lose its competitive edge. For Nvidia stock investors, the risk of technological obsolescence is a key concern, especially given the pace of change in AI, autonomous driving, and other sectors Nvidia targets.

7. Financial Risks

Nvidia’s growth strategy involves significant capital expenditures and investments in research, development, and acquisitions. While these investments aim to drive future growth, they also come with risks. If these initiatives do not deliver the expected returns, Nvidia may face financial strain or reduced profitability. For Nvidia stock investors, understanding the potential financial risks associated with the company’s aggressive growth strategy is essential.

8. Legal and Intellectual Property Risks

Nvidia is involved in ongoing legal disputes related to intellectual property rights, patents, and antitrust issues. These legal challenges can result in costly settlements or fines and could potentially impact Nvidia’s business operations. For Nvidia stock investors, legal risks are a factor to consider, especially if the outcomes could significantly affect the company’s financial standing or reputation.

ESG Factors and Social Impact

For Nvidia stock investors, understanding the company’s commitment to Environmental, Social, and Governance (ESG) factors is increasingly important. Nvidia has made significant strides in these areas, aiming to align its business practices with sustainable and socially responsible goals. Here’s an overview of how Nvidia addresses ESG considerations and its broader social impact.

1. Environmental Responsibility

Nvidia is committed to minimizing its environmental footprint through various sustainability initiatives. The company focuses on reducing greenhouse gas emissions, conserving energy, and managing waste. Nvidia has set ambitious goals to achieve 100% renewable energy use for its global operations by 2025. Additionally, it strives to make its data centers more energy-efficient, which is crucial given the high energy consumption associated with GPU computing.

Nvidia also works to minimize the environmental impact of its products throughout their lifecycle. This includes designing energy-efficient GPUs, optimizing manufacturing processes to reduce waste, and promoting recycling programs. For Nvidia stock investors, these environmental initiatives enhance the company’s appeal to those who prioritize sustainable investments.

2. Social Responsibility and Community Engagement

Nvidia emphasizes social responsibility through initiatives that support diversity, equity, and inclusion within the company and the broader community. The company actively promotes a diverse and inclusive workplace, with a focus on increasing representation across all levels of the organization. Nvidia’s efforts in this area have been recognized in various diversity rankings, reflecting its commitment to fostering a supportive and equitable work environment.

Nvidia is also involved in numerous community outreach programs. The company has partnered with educational institutions to promote STEM (Science, Technology, Engineering, and Mathematics) education and provide opportunities for underserved communities. Moreover, Nvidia contributes to global challenges by offering its AI technology to tackle issues such as climate change, healthcare, and disaster response. These social initiatives underscore Nvidia’s commitment to making a positive impact on society, which is a key consideration for Nvidia stock investors.

3. Governance Practices and Ethical Standards

Strong governance is central to Nvidia’s business strategy. The company has a diverse and experienced board of directors that provides oversight and ensures accountability. Nvidia adheres to high ethical standards, with policies in place to combat corruption, ensure transparency, and uphold the rights of all stakeholders. It regularly reviews and updates its governance practices to align with global best practices, which helps build trust with investors and the public.

Nvidia also places significant emphasis on cybersecurity and data privacy, ensuring its products and services protect user data and comply with international regulations. For Nvidia stock investors, this strong governance framework reduces risks related to ethical misconduct and enhances long-term business stability.

4. ESG Ratings and Investor Appeal

Nvidia’s efforts in ESG have been recognized by various rating agencies. The company consistently receives strong ESG scores, reflecting its commitment to sustainable practices and ethical governance. High ESG ratings make Nvidia more attractive to institutional investors and funds that prioritize ESG criteria in their investment decisions.

For Nvidia stock investors, a strong ESG profile not only aligns with ethical values but also reduces long-term risks associated with regulatory changes, market volatility, and reputational damage. Companies with robust ESG practices tend to perform better financially over the long term, which can translate into stable returns for investors.

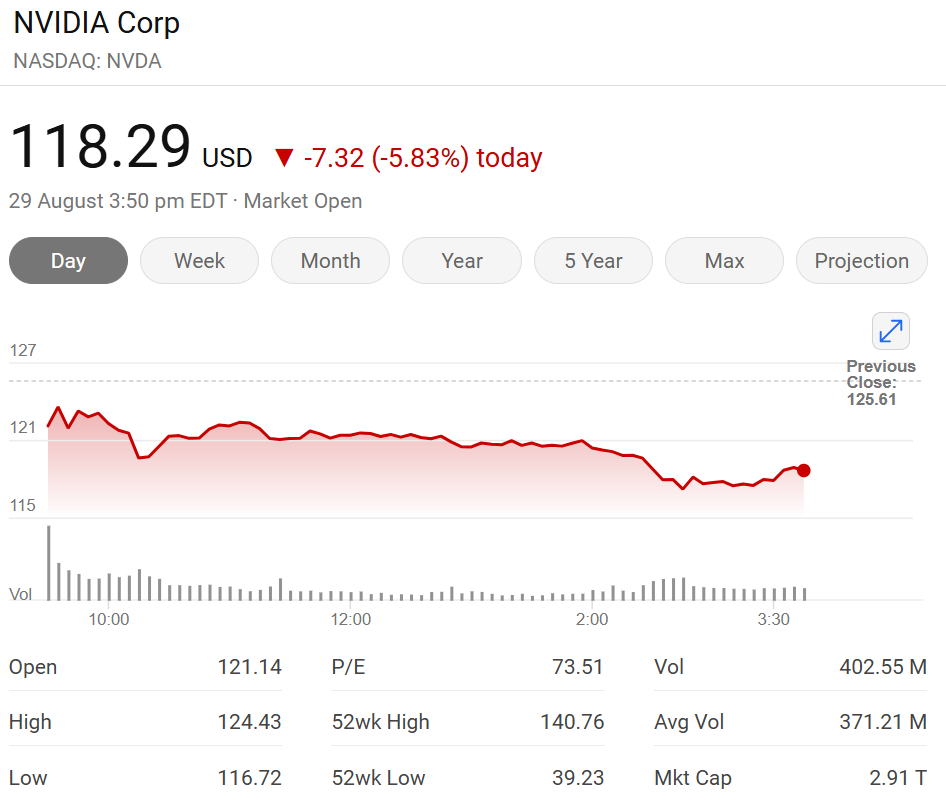

Investor Sentiment and Market Perception

Investor sentiment and market perception play a crucial role in determining the performance of any stock, and Nvidia is no exception. For Nvidia stock investors, understanding how the market views the company can provide valuable insights into potential stock movements and investment decisions.

1. Current Investor Sentiment

Investor sentiment towards Nvidia has generally been positive, fueled by the company’s strong financial performance and leadership in key growth markets such as artificial intelligence (AI), gaming, and data centers. Many analysts and investors are optimistic about Nvidia’s future, driven by its ability to innovate and maintain a competitive edge in these high-demand sectors. The company’s consistent revenue growth, robust earnings reports, and strategic acquisitions, like the purchase of Mellanox and ARM (pending regulatory approval), have strengthened investor confidence.

Positive investor sentiment is also reflected in Nvidia’s stock price, which has seen substantial growth over the past few years. Even amid market volatility, Nvidia stock has demonstrated resilience, largely due to the company’s solid fundamentals and market leadership. For Nvidia stock investors, this optimistic sentiment is a key indicator of the market’s faith in Nvidia’s long-term growth prospects.

2. Factors Influencing Market Perception

Several factors shape market perception of Nvidia. First and foremost is the company’s ability to capitalize on emerging technology trends. Nvidia is seen as a leader in AI, machine learning, and graphics processing, all of which are expected to drive significant demand in the coming years. The market also perceives Nvidia positively due to its diversified product portfolio, which reduces reliance on any single market segment and spreads risk across multiple high-growth areas.

However, market perception is not without concerns. Some investors worry about Nvidia’s valuation, which has been relatively high compared to its peers. High valuations can lead to volatility, especially in uncertain economic conditions. For Nvidia stock investors, understanding this aspect of market perception is crucial, as it can impact both short-term and long-term investment strategies.

3. Media Coverage and Public Opinion

Media coverage also plays a significant role in shaping investor sentiment and market perception. Nvidia frequently receives positive coverage for its technological innovations, strategic moves, and strong financial results. Articles highlighting Nvidia’s advancements in AI, data centers, and gaming reinforce the positive sentiment among investors.

However, any negative news, such as regulatory hurdles or competition challenges, can swiftly impact public opinion and market perception. For example, delays or complications in the ARM acquisition have created some uncertainty in the market. For Nvidia stock investors, keeping an eye on both positive and negative media coverage can help anticipate potential shifts in stock performance.

4. Analyst Recommendations and Ratings

Analyst recommendations are another key factor influencing investor sentiment and market perception. Many analysts currently rate Nvidia as a “Buy” or “Strong Buy,” citing its growth potential in AI, gaming, and data centers. Price targets from various analysts often reflect expectations of continued upward momentum, reinforcing positive sentiment among Nvidia stock investors.

Conversely, some analysts caution about the risks associated with high valuation, regulatory challenges, and competitive pressures. Mixed analyst opinions can lead to varying degrees of sentiment among different groups of investors, which may result in short-term fluctuations in Nvidia’s stock price.

5. Social Media and Retail Investor Sentiment

The rise of social media and online forums has amplified the voice of retail investors, who often express their views on platforms like Twitter, Reddit, and StockTwits. Nvidia enjoys a strong following among retail investors, who are generally bullish on the stock due to its reputation as a leader in cutting-edge technology. For Nvidia stock investors, monitoring social media sentiment can provide a sense of retail investor mood, which sometimes drives short-term market movements.

Strategies for Investing in Nvidia Stock

For Nvidia stock investors, adopting the right strategies is crucial to maximizing returns while managing risk. Given Nvidia’s strong market position and growth potential in key technology sectors, several approaches can help investors navigate the complexities of this dynamic stock.

1. Long-Term Buy and Hold Strategy

One of the most popular strategies for Nvidia stock investors is the long-term buy and hold approach. This strategy involves purchasing Nvidia shares and holding onto them for an extended period, typically several years or more. The rationale behind this approach is Nvidia’s strong fundamentals, including consistent revenue growth, leadership in high-growth markets like AI, gaming, and data centers, and a track record of innovation.

By holding Nvidia stock over the long term, investors can benefit from potential appreciation in stock value, compounded by Nvidia’s growth in emerging sectors. This strategy is well-suited for those who believe in Nvidia’s ability to maintain its competitive edge and continue expanding its market presence.

2. Dollar-Cost Averaging (DCA)

For Nvidia stock investors looking to minimize risk, Dollar-Cost Averaging (DCA) is a sound strategy. This involves investing a fixed amount of money in Nvidia stock at regular intervals, regardless of the share price. By doing so, investors can average out the purchase price over time, reducing the impact of short-term market volatility.

DCA is particularly useful for those who want to invest in Nvidia but are concerned about potential price fluctuations or market corrections. It allows investors to build their positions gradually while potentially lowering the average cost per share.

3. Growth Investing

Given Nvidia’s strong performance in high-growth sectors, another effective strategy is growth investing. Nvidia stock investors who pursue this approach focus on the company’s potential for rapid expansion and capital gains, driven by its dominance in areas like AI, data centers, and gaming.

Growth investors typically look for stocks with high earnings growth rates, which Nvidia has consistently demonstrated. They are often willing to accept higher risk for the potential of substantial returns. This strategy is ideal for investors with a higher risk tolerance who are looking to capitalize on Nvidia’s future growth prospects.

4. Dividend Reinvestment

Although Nvidia’s current dividend yield is modest, investors can still benefit from a dividend reinvestment strategy. This involves automatically reinvesting any dividends received to purchase additional Nvidia shares. Over time, this can lead to compounded growth, increasing the total investment value.

For Nvidia stock investors, reinvesting dividends can be a low-effort way to enhance returns, especially if they believe in the company’s long-term growth potential. While dividends may not be a primary driver for Nvidia investors, this strategy can still contribute to wealth accumulation over time.

5. Swing Trading or Short-Term Trading

For more active investors, swing trading or short-term trading might be appealing strategies. This involves buying Nvidia stock during price dips and selling during price rallies to capitalize on short-term market movements. Given Nvidia’s market volatility, there are often opportunities for short-term profits.

However, this approach requires careful monitoring of the market, a solid understanding of technical analysis, and the ability to act quickly. It is best suited for Nvidia stock investors with experience in trading and a higher risk tolerance who are comfortable navigating short-term price fluctuations.

6. Options Trading

For Nvidia stock investors interested in more advanced strategies, options trading can offer opportunities to generate income or hedge against potential losses. For example, selling covered calls against existing Nvidia stock holdings can generate additional income if the stock price remains relatively stable.

Conversely, buying put options can provide a hedge against downside risk, allowing investors to limit potential losses if Nvidia’s stock price falls. However, options trading involves significant risk and complexity, making it more suitable for experienced investors who understand the nuances of derivatives.

7. Diversification

No matter the strategy, diversification is a fundamental principle for Nvidia stock investors. While Nvidia offers substantial growth potential, it’s essential to balance the portfolio with investments in other sectors or asset classes to mitigate risk. Diversifying can help protect against the potential downside if Nvidia’s stock faces unforeseen challenges.

By investing in a mix of stocks, bonds, or other assets, investors can reduce the impact of any single investment’s poor performance on their overall portfolio. This strategy is particularly important for those who wish to hold Nvidia stock for the long term while minimizing risk.